Financial Lessons Learned From My Dad

By Jay Gershman

Research has proven that much of how we relate to saving and spending is learned from our parents and grandparents, and those values are set in stone by our teenage years.

This week, my dad Shike would have turned 89. He passed away last June and on the days when I meet new clients to talk about their finances, I realize how much of both my beliefs about money and my work ethic were instilled in me by him.

My father’s favorite thing to do was to talk about the past and he had a sweet spot for reminiscing about his father Benny’s business, the Home Circle Grocery Store on Zion Street across from Trinity College. Benny immigrated to the United States at age 11 from Russia and he worked hard enough to bring his entire family to our country over the next 20 years. In addition to paying for every family member, Benny also had to pay for his son (my father) to be hospitalized for three months at age of two. When my father recounted the story, he reminded me that his father’s $8,000 debt to the hospital would be approximately $300,000 today.

Debt was always a topic of conversation in our household and this story was my dad’s way of teaching me about it. My dad owned a small business just like his father, a drugstore on New Britain Avenue, and my first lessons about money and debt started right here. At the age of seven, I started working the cash register and according to my dad, I mastered the art of giving perfect change. It was my first exposure to what has since become my career, but those simple, early lessons are the ones that I still find the most useful. What I learned from him have stayed with me, and there are a few that I’d like to pass on to you:

- Dad used envelopes tacked to a cork board to show me he could save in small amounts to accomplish big things. This taught me the essence of work for reward.

- He told me, “Don’t lend money if you can’t afford to not get it back.”

- As an investor, he told me to be patient because the first thirty years he invested, he earned very little. Luckily, the period after 1982 more than made up for it.

- When the market crashed during his retirement, instead of panicking, he said, “If I had another $10,000 in cash, I would invest right now.”

- As a retiree, he reminded me that, “The value of your portfolio doesn’t matter, only the income it produces.”

- Finally, he would say, “If you want to get something done, and we all do, ask a busy person.”

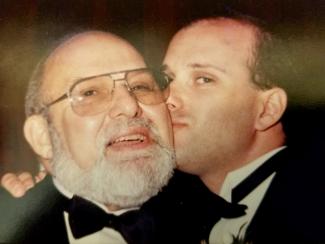

After my dad passed away, I received a framed photo of me kissing him at my wedding. Under the photo was a ten dollar bill. Many years ago, my dad asked me to pick up something for him at the local drugstore. He insisted on paying me for it - one of his lessons. I figured I was a grown man and it was time to repay him for all he had done. He would have no part of it and I refused to accept it. For months, both of us found funny ways to give each other the ten back and finally I had the last word. I framed it with the photo and a note that read “Thanks Dad for all that you’ve done, I could never repay you but this will be a down payment. Love, Jay.”

Securities offered through Securities Service Network, LLC. Member FINRA/SIPC. Fee based services are offered through SSN Advisory, Inc., a registered investment advisor.